Top 5 Stocks in focus after RBI Repo rate cut

The RBI’s 25 basis point rate cut to 6.25% is expected to influence several sectors, especially banking, NBFCs, real estate, and auto. Here are the top 5 stocks to watch as markets react to this monetary policy decision. RBI Governor Sanjay Malhotra announced that the decision to cut the repo rate to 6.25% was made with full agreement from all committee members. He mentioned that the global economic situation is still tough and added that the progress in reducing global inflation is slowing down.

- Bajaj Finance – NBFCs like Bajaj Finance gain from reduced funding costs, improving net interest margins (NIMs).

2. Maruti Suzuki India : Auto stocks generally react positively to rate cuts as vehicle loans become more affordable, driving sales.

3. State Bank of India : As the country’s largest public sector bank, SBI will benefit from a potential surge in loan demand, both retail and corporate.

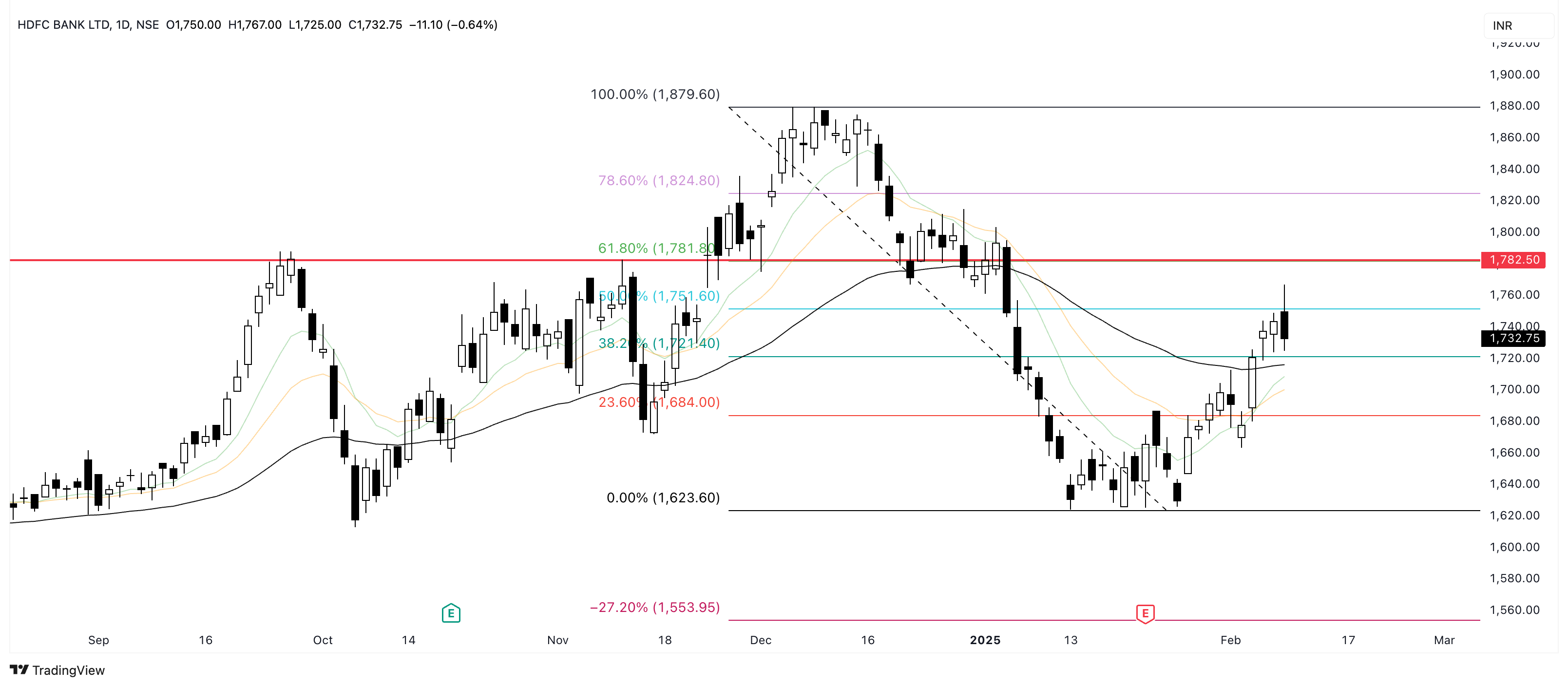

4. HDFC Bank : As one of India’s largest private lenders, HDFC Bank stands to benefit from lower borrowing costs, potentially boosting credit growth.

5. Kotak Mahindra Bank : The bank’s stock may see positive momentum in the short term if investors anticipate higher loan growth. Kotak Mahindra Bank has formed higher bottoms on the weekly scale, and for the past two weeks, it has sustained above its sloping trendline drawn from its multi-year high since 2021, indicating trend improvement.

DISCLAIMER :

The views and investment tips expressed by investment experts/broking houses/rating agencies on samvadmantra.com are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. samvadmantra or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The views and investment tips expressed by investment experts/broking houses/rating agencies on samvadmantra.com are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. samvadmantra or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.